Tax Filing Extension 2025

Tax Filing Extension 2025. With a tax extension, you have until oct. If you believe you will owe taxes, you.

If october 15 falls on a saturday, sunday,. The same goes for businesses:

To Request An Automatic 6 Month Extension, Businesses Use Form 7004, And.

If you owe money, you'll need to make a payment by the filing deadline — which is april 15 for the 2025 filing season — in order to avoid penalties and interest.

The Same Goes For Businesses:

With a tax extension, you have until oct.

Discover The Process Of Obtaining An Extension And The Revised Tax Filing Deadline, Which Is October 15.

Images References :

Source: selectstudentservices.com

Source: selectstudentservices.com

How To Extend Your Tax Filing Date And Not Pay, According to the kentucky dor, if you get a federal extension, you automatically have an extension to file with kentucky. An extension gives you until october 16, 2023, to file your 2022 federal.

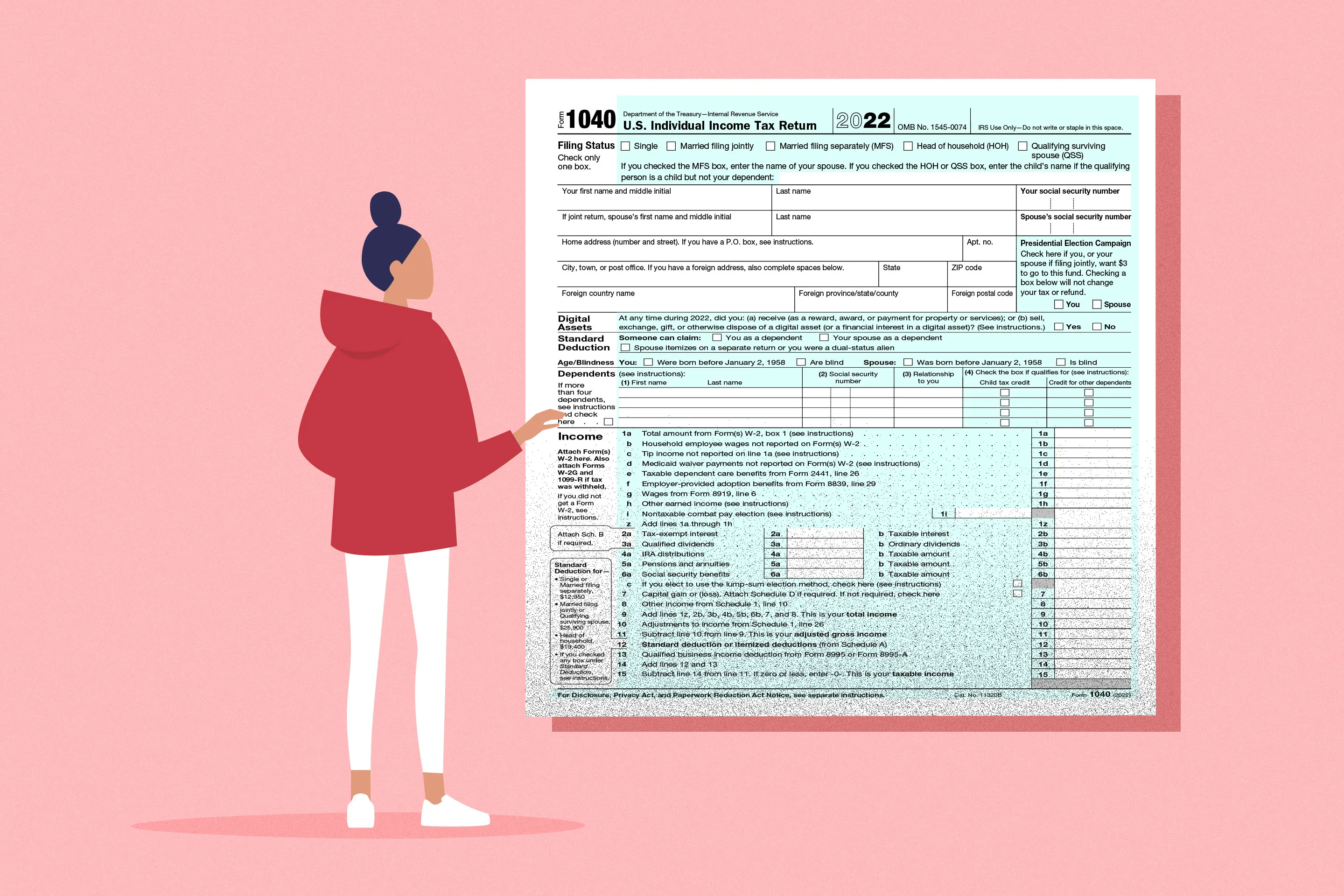

Source: www.dochub.com

Source: www.dochub.com

Printable irs form 4868 Fill out & sign online DocHub, S corps and partnerships can still get an extension on march. 27, 2025 — the internal revenue service announced today tax relief for individuals and businesses in parts of california affected by severe storms and flooding.

![How To File A Tax Extension A Complete Guide [INFOGRAPHIC]](https://help.taxreliefcenter.org/wp-content/uploads/2018/03/20190222-Tax-Relief-Center-How-To-File-A-Tax-Extension.jpg) Source: help.taxreliefcenter.org

Source: help.taxreliefcenter.org

How To File A Tax Extension A Complete Guide [INFOGRAPHIC], A tax extension is a request for an additional six months to file your federal income tax return with the irs. If you owe money, you'll need to make a payment by the filing deadline — which is april 15 for the 2025 filing season — in order to avoid penalties and interest.

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png) Source: glenramsey953viral.blogspot.com

Source: glenramsey953viral.blogspot.com

How To File Tax Extension Self Employed, Your guide to filing a tax extension, including key dates, how to file a tax extension in 2025 and the forms you will need. The same goes for businesses:

![How To File A Tax Extension A Complete Guide [INFOGRAPHIC]](https://help.taxreliefcenter.org/wp-content/uploads/2019/03/Feature-Image-Tax-Relief-Center-How-To-File-A-Tax-Extension.jpg) Source: help.taxreliefcenter.org

Source: help.taxreliefcenter.org

How To File A Tax Extension A Complete Guide [INFOGRAPHIC], For individuals, that means you can still file for a tax extension right on april 15, 2025. A tax extension is a request for an additional six months to file your federal income tax return with the irs.

Source: en.as.com

Source: en.as.com

IRS File for Tax Extension how to apply and where to apply to IRS Form, If october 15 falls on a saturday, sunday,. 2025 tax deadline to file for an extension for 2023 tax returns.

![How To File A Tax Extension A Complete Guide [INFOGRAPHIC]](https://help.taxreliefcenter.org/wp-content/uploads/2019/03/TRC-PIN-Filing-Tax-Extension-_-A-Complete-Guide-.png) Source: help.taxreliefcenter.org

Source: help.taxreliefcenter.org

How To File A Tax Extension A Complete Guide [INFOGRAPHIC], Your accountant or crypto tax filing software can file your extension for you. Special considerations for business tax filing deadlines in 2025 extension requests:

Source: www.marca.com

Source: www.marca.com

IRS Form 4868 How to get a tax extension in 2022? Marca, Filing this form gives you until october 15 to file a return. A tax extension is a request for an additional six months to file your federal income tax return with the irs.

Source: www.zenledger.io

Source: www.zenledger.io

How to File a Tax Extension? ZenLedger, If october 15 falls on a saturday, sunday,. For individuals, that means you can still file for a tax extension right on april 15, 2025.

Source: c937jessienorman.blogspot.com

Source: c937jessienorman.blogspot.com

How To File Tax Extension Self Employed, There are two ways you can file for an extension: Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for.

If You Pay Your Estimated Taxes Via The.

Under the act as currently written, new.

The Same Goes For Businesses:

As an expat there are multiple deadlines, which can be confusing.